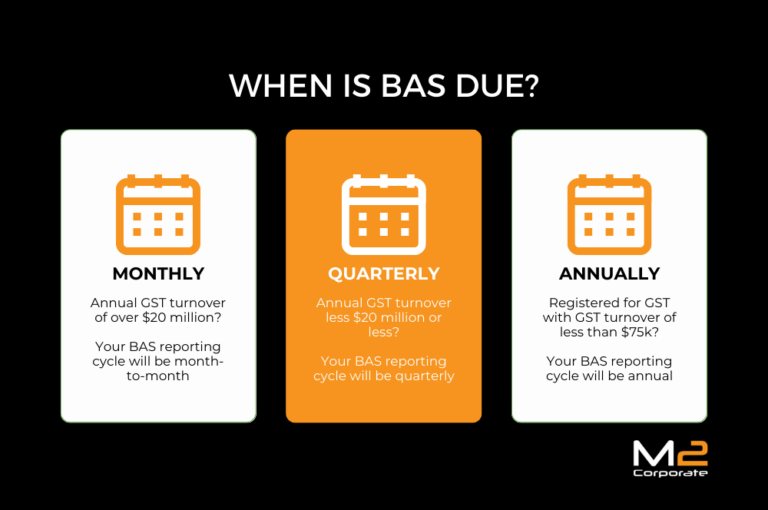

Make BAS Preparation Easier with These TimeSaving Tips Work, Lodge and pay june 2025 monthly bas. These are the four bas due dates for each quarter:

What is BAS Due Dates [2025 2025] and How to Lodge it My Tax Daily, Submitting your business activity statement (bas) is a key part of your tax schedule as a tradesperson in construction, whether you’re an electrician, plumber, or. The due date for lodgment (and payment if required) of annual gst returns is either:

When Is BAS Due in 20232024? Everything You Need to Know, Get insights on penalties, extensions, and. Is the 21st day of the.

When Are Federal Estimated Taxes Due 2025 Gilda Etheline, Due date 28 february 2025. 28th day after each quarter, with an exception for q2.

2025 Tax Due Date Betsy Lucienne, Submitting your business activity statement (bas) is a key part of your tax schedule as a tradesperson in construction, whether you’re an electrician, plumber, or. The irs has announced that eligible individuals, particularly new parents from 2025, can still claim $1400 stimulus checks by filing their tax returns by may 17, 2025.

![What is BAS Due Dates [2025 2025] and How to Lodge it My Tax Daily](https://mytaxdaily.com.au/wp-content/uploads/2023/10/bas-due-dates-1024x683.webp)

Business Taxes Due 2025 Tiff Anabelle, The due date for lodging and paying is displayed on your business activity statement (bas). The bas due dates for 2025/2025 are as follows:

When Is BAS Due in 20232024? Everything You Need to Know, As some dates may vary, please ensure you contact the australian taxation office to double check any dates in question. Bas agent concession for lodgment and payment if lodging by online services for agents or pls.

Bas Due Dates 2025, Keep your business on track with these key bas due dates for 2025: 28th day after each quarter, with an exception for q2 (28 february 2025).

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Due Dates for BAS Jaha Online Accountant, The due date for lodging and paying is displayed on your business activity statement (bas). Submitting your business activity statement (bas) is a key part of your tax schedule as a tradesperson in construction, whether you’re an electrician, plumber, or.

News Small Business Bookkeeping, Last updated 15 april 2025. 28th day after each quarter, with an exception for q2 (28 february 2025).