Wa State Payroll Taxes 2025. For 2025 the wage base is $68,500 up from $67,600 in 2025. As for the 2025 pfml payroll tax rate, which the state erroneously calls a “premium,” employers with 50 or more employees will pay 28.57% of the tax and.

To effectively use the washington paycheck. Use adp’s washington paycheck calculator to estimate net or “take home” pay for either hourly or salaried employees.

Understanding California Payroll Tax finansdirekt24.se, Calculate payroll costs for up to 20 employees in washington in 2025 for free ( view alternate tax years available ). List of washington state payroll taxes for 2025 / 2025.

State Payroll Taxes Everything You Need to Know in 2025, To effectively use the washington paycheck. Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual washington salary calculator.

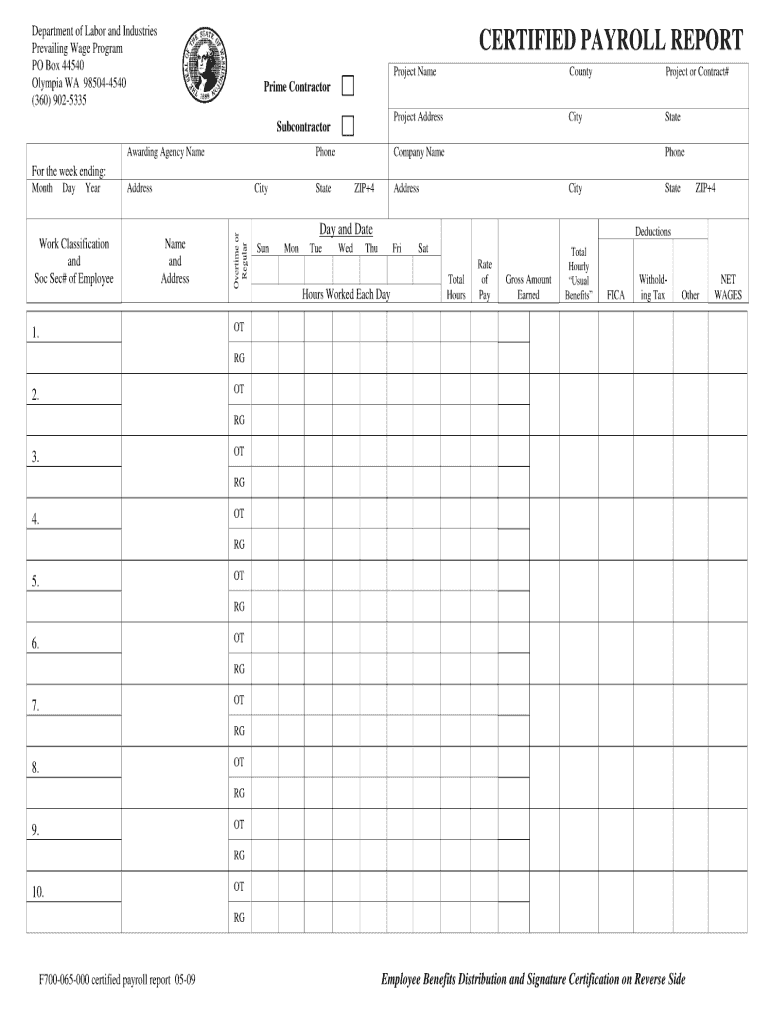

Lni prevailing wage Fill out & sign online DocHub, The 2025 tax rates and thresholds for both the washington state tax tables and federal tax tables are comprehensively integrated into the washington tax calculator for. Enter your gross salary, pay frequency, and other relevant details to calculate your net income after all state and federal taxes.

How to Calculate Employee Payroll Taxes in 2025 GeekBooks, Payroll tax is a self assessed tax meaning that the onus is on you, as an employer, to ensure that any information you provide is correct and that. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

State Payroll Taxes Everything You Need to Know in 2025, Calculate payroll costs for up to 20 employees in washington in 2025 for free ( view alternate tax years available ). Washington state employers must understand the following payroll taxes for 2025 / 2025:

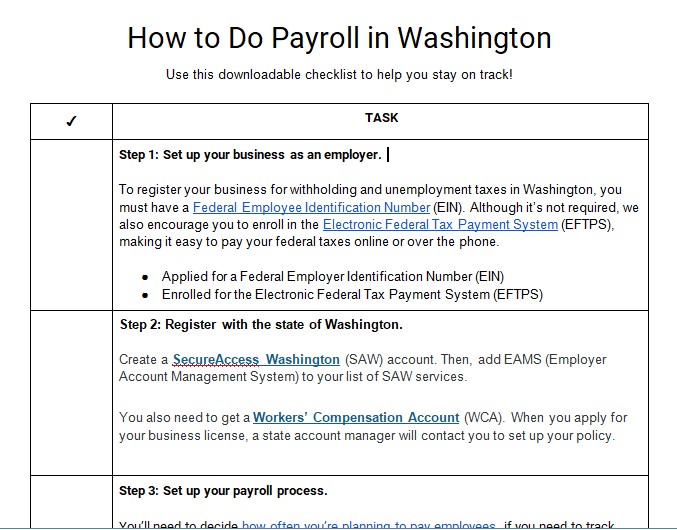

How to Do Payroll in Washington State, Payroll tax is a self assessed tax meaning that the onus is on you, as an employer, to ensure that any information you provide is correct and that. List of washington state payroll taxes for 2025 / 2025.

The Complete Guide To Washington State Tax & Payroll Taxes (2025), A diminishing threshold will apply for employers or. Washington state employers must understand the following payroll taxes for 2025 / 2025:

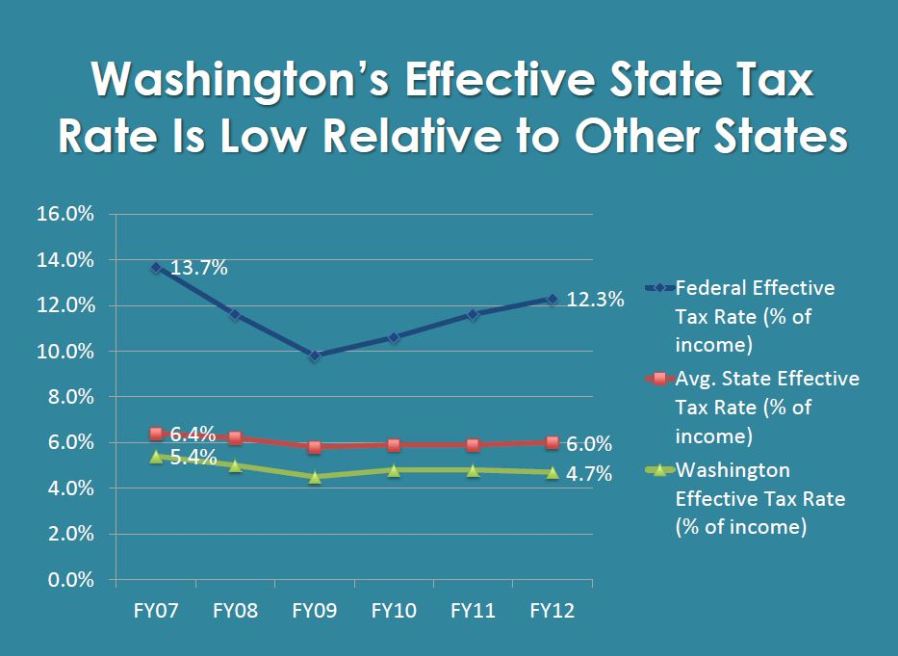

Washington State House Democrats » The truth about taxes in Washington, Calculate payroll costs for up to 20 employees in washington in 2025 for free ( view alternate tax years available ). A diminishing threshold will apply for employers or.

Idaho Tax Calculator 2025 Nevsa Adrianne, Washington state employers must understand the following payroll taxes for 2025 / 2025: The taxable wage base is the maximum amount on which you must pay taxes for each employee.

How to calculate payroll taxes 2025 QuickBooks, How much do you make after taxes in washington? Before starting to pay employees in the state, you must consider several areas of washington state payroll law, including the minimum wage, overtime, allowed.